The Gold Standard

During the 19th century all the main countries of the world adhered to a fixed-exchange rate system known as the Gold Standard. Therefore the domestic money supply is directly tied to each country’s stock of gold. "Those countries with a trade deficit, who are sending more currency abroad to buy foreign goods than they are receiving from exports, find that their money supply is automatically contracted. This depresses their domestic price level. With lower prices, the deficit country’s exports quickly become more attractive to foreign countries, while imports become more expensive, clearing the deficit." (1)

Robert Skidelsky has pointed out: "Their domestic currencies were freely convertible into specified amounts of gold; they maintained fixed proportions between the quantity of money in circulation and the gold reserves of their central banks. An ounce of gold was worth 3.83 pounds sterling and dollars 18.60, giving a sterling-dollar exchange rate of 4.86. The appeal of the gold standard was that it provided not just exchange rate stability, which encouraged international trade, but promised long-run stability in prices, since the obligation to maintain convertibility acted as a check on the 'over-issue' of notes by governments." (2)

First World War and the Gold Standard

By the 20th century the gold standard was seen as providing stability, low interest rates and a steady expansion in world trade. On the outbreak of the First World War Germany immediately left the gold standard. Britain followed soon afterwards. In financing the war and abandoning gold, many of the belligerents suffered serious problems with inflation. Price levels doubled in Britain, tripled in France and quadrupled in Italy. The economist, Richard G. Lipsey, has pointed out that the gold standard could not cope with the consequences of a world war. (3)

Under the terms of the Versailles Treaty the Allies confiscated Germany's gold supplies. They were therefore unable to return to the gold standard. During the Occupation of the Ruhr the German central bank (Reichsbank) issued enormous sums of non-convertible marks to support workers who were on strike against the French occupation and to buy foreign currency for reparations; this led to the German hyper-inflation of the early 1920s and helped to undermine confidence in the country's financial system. It also provided a warning of what could happen when a country managed its own currency. (4)

Winston Churchill: Chancellor of the Exchequer

Winston Churchill rejoined the Conservative Party and on 6th November, 1924 Stanley Baldwin appointed him as Chancellor of the Exchequer. His biographer, Clive Ponting pointed out that he "had no experience of financial or economic matters". He had "taken virtually no interest in such questions and the only ideas on economic policy he was known to advocate were free trade and sound finance". Ponting adds that "he was, unusually for him, lacking in self-confidence on economic policy and proved much more willing to accept conventional wisdom and the advice of experts." (5)

Churchill had no experience of financial or economic matters when he went to the Treasury in November 1924. He made it clear to Sir Richard Hopkins, the chairman of the Board of Inland Revenue that he had no intention of increasing taxes on the rich: "As the tide of taxation recedes it leaves the millionaires stranded on the peaks of taxation to which they have been carried by the flood... Just as we have seen the millionaire left close to the high water mark and the ordinary Super Tax payer draw cheerfully away from him, so in their turn the whole class of Super Tax payer will be left behind on the beach as the great mass of the Income Tax payers subside into the refreshing waters of the sea." (6)

Churchill's first major decision concerned the Gold Standard. Britain had left the gold standard in 1914 as a wartime measure, but it was always assumed by the City of London financial institutions that once the war was over Britain would return to the mechanism that had seemed so successful before the war in providing stability, low interest rates and a steady expansion in world trade. However, at the end of the First World War, the British economy was in turmoil. After a short-term boom in 1919 gross domestic fell by six per cent and unemployment rose rapidly to 23 per cent. (7)

Otto Niemeyer, Controller of Finance at the Treasury, and Montagu Norman, Governor of the Bank of England, and a handful of bankers argued that Churchill should return to the gold standard. Churchill had discussions with John Maynard Keynes and Reginald McKenna, chairman of the Midland Bank, who were both against the move. The Federation of British Industry, favoured postponement. Industrialists were not consulted, Norman commented that their views on the subject was comparable to asking shipyard workers what they thought about the "design of a battleship." (8)

According to Percy J. Grigg, Churchill's private secretary, at a meeting on 17th March, 1925, Keynes told the Chancellor of the Exchequer, that a return to the gold standard would result in an increase in "unemployment and downward adjustment of wages and prolonged strikes in some of the heavy industries, at the end of which it would be found that these industries had undergone a permanent contraction". It was therefore "better to keep domestic prices and nominal wage rates stable and allow the exchanges to fluctuate for the time being." (9)

Churchill found Keynes arguments convincing. He told Niemeyer he was concerned about the attitude of the Governor of the Bank of England: "The Treasury have never, it seems to me, faced the profound significance of what Mr Keynes calls the 'paradox of unemployment amidst dearth'. The Governor shows himself perfectly happy at the spectacle of Britain possessing the finest credit in the world simultaneously with a million and a quarter unemployed. It is impossible not to regard the object of full employment as at least equal, and probably superior, to the other valuables objectives you mention... The community lacks goods, and a million and a quarter people lack work. It is certainly one of the highest functions of national finance to bridge the gulf between the two." (10)

Niemeyer said to dodge the issue now would be to show that Britain had never really "meant business" about the Gold Standard and that "our nerve had failed when the stage was set." Norman added that in the opinion "of educated and reasonable men" there was no alternative to a return to Gold. The Chancellor would no doubt be attacked whatever he did but "in the former case (Gold) he will be abused by the ignorant, the gamblers and the antiquated industrialists". (11)

Churchill also sought the advice of Philip Snowden, who had served as Chancellor of the Exchequer, in the previous Labour government. Snowden said he was in favour of a return to the Gold Standard at the earliest possible moment. On 17th March, 1925, Churchill gave a dinner that was attended by supporters and opponents of returning to the Gold Standard. He admitted that Keynes provided the better arguments but as a matter of practical politics he had no alternative but to go back to Gold. (12)

Roy Jenkins has argued that the return to the Gold Standard was the gravest mistake of the Baldwin government: "Churchill was deliberately a very attention-attracting Chancellor. He wanted his first budget to make a great splash, which it did, and a considerable contribution to the spray was made by the announcement of the return to Gold. Reluctant convert although he had been, he therefore deserved the responsibility and, if it be so judged, a considerable part of the blame." (13)

Despite these concerns, on 28th April, 1925, Churchill announced the return to the gold standard in the House of Commons. Churchill fixed the price at the pre-war rate of $4.86. "If we had not taken this action the whole of the rest of the British Empire would have taken it without us, and it would have come to a gold standard, not on the basis of the pound sterling, but a gold standard of the dollar." (14)

John Maynard Keynes

John Maynard Keynes offered Geoffrey Dawson, the editor of The Times, a series of articles on the effects of the return to the gold standard. When he saw them he turned them down: "They are extraordinary clever and very amusing; but I really feel that, published in The Times at this particular moment, they would do harm and not good." (15) William Maxwell Aitken, Lord Beaverbrook, was more receptive and the articles appeared in the Evening Standard, in July, 1925. This was followed by a pamphlet, The Economic Consequences of Mr. Churchill. (16)

Keynes argued: "Our troubles arose from the fact that sterling's value had gone up by 10 per cent in the previous year. The policy of improving the exchange by 10 per cent involves a reduction of 10 per cent in the sterling receipts of our export industries". But they could not reduce their prices by 10 per cent and remain profitable unless all internal prices and wages fell by 10 per cent. "Thus Mr. Churchill's policy of improving the exchange by 10 per cent was, sooner or later, a policy of reducing everyone's wages by 2s. in the pound." Keynes went on to suggest that workers would be "justified in defending themselves" because they had no guarantee that they would be compensated later by a lower cost of living. (17)

Selina Todd pointed out in The People: The Rise and Fall of the Working Class (2014): "Churchill wanted to raise the value of the pound against other national currencies; a morale boost for those who recalled Britain's imperial pre-eminence in the years before 1914 but - as the economist John Maynard Keynes predicted - disastrous for the British economy. In 1914 Britain's government and industrialists had been able to rely on the empire both to produce and consume British goods. But by 1925 British industrialists relied heavily on exporting goods, and manufactures had to price their goods competitively in the free international market. Churchill's move made exports prohibitively expensive." (18)

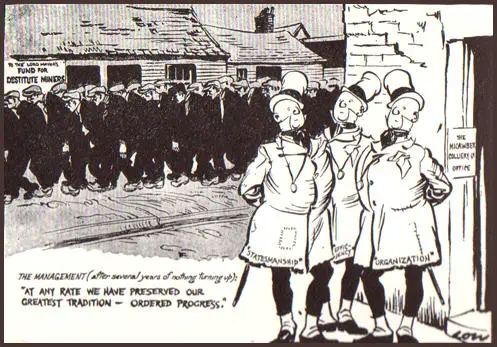

It has been argued that Churchill overvalued sterling by at least ten per cent. "Domestically the results were disastrous. The overvalued pound meant the costs had to be reduced in an unavailing attempt to keep exports competitive and this at a time when real wages were already below 1914 levels. Attempts to impose further wage reductions inevitably led to industrial disputes, lock-outs, strikes, rising unemployment and increased social strains. The overvalued pound made perhaps as many as 700,000 people unemployed. The impact showed up the 1925 decision for what it was - a banking and financial policy designed to benefit the City of London." (19)

National Government and the Gold Standard

On 8th September 1931, the National Government's programme of £70 million economy programme was debated in the House of Commons. This included a £13 million cut in unemployment benefit. All those paid by the state, from cabinet ministers and judges down to the armed services and the unemployed, were cut 10 per cent. Teachers, however, were treated as a special case, lost 15 per cent. Tom Johnson, who wound up the debate for the Labour Party, declared that these policies were "not of a National Government but of a Wall Street Government". In the end the Government won by 309 votes to 249. (20)

John Maynard Keynes spoke out against the morality of cutting benefits and public sector pay. He claimed that the plans to reduce the spending on "housing, roads, telephone expansion" was "simply insane". Keynes went on to say the government had been ignoring his advice: "During the last 12 years I have had very little influence, if any, on policy. But in the role of Cassandra, I have had considerable success as a prophet. I declare to you, and I will stake on it any reputation I have, that we have been making in the last few weeks as dreadful errors of policy as deluded statesmen have ever been guilty of." (21)

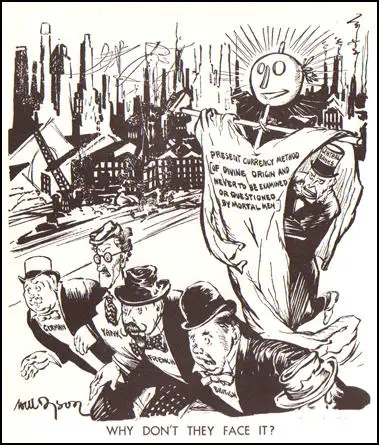

The cuts in public expenditure did not satisfy the markets. The withdrawals of gold and foreign exchange continued. John Maynard Keynes published an article in the Evening Standard on 10th September, urging import controls and the leaving of the Gold Standard. (22) Two days later he argued in the New Statesman that the government policy "can only delay, it cannot prevent, a recurrence of another crisis similar to that through which we have just passed." (23)

A mutiny of naval ratings at Invergordon on 16th September, led to another run on the pound. That day the Bank of England lost £5 million in defending the currency. This was followed by losing over 10 million on 17th and over 16 million on the 18th. The governor of the Bank of England told the government that it had lost most of its original gold and foreign exchange. On the 20th September, the Cabinet agreed to leave the Gold Standard, something that Keynes had been telling the government to do for several years. (24)

Primary Sources

(1) Mark Harrison, The Financial Times (16th June, 2013)

In the classical gold standard of the late 19th century, the domestic money supply is directly tied to each country’s stock of gold. Those countries with a trade deficit, who are sending more currency abroad to buy foreign goods than they are receiving from exports, find that their money supply is automatically contracted. This depresses their domestic price level. With lower prices, the deficit country’s exports quickly become more attractive to foreign countries, while imports become more expensive, clearing the deficit.

Under this elegant system, global imbalances are automatically restrained by credit expansion in surplus countries and contractions in deficit countries. Exchange rates are fixed, and any deviation of domestic price levels from the world gold price triggers exports or imports of physical gold before things move too far from equilibrium. Deficit countries are prevented from consuming the part of their production that they will need for exports to rebalance.

Gold standards are a recurring theme, yet few of them seem particularly successful. In the last century, a procession of gold standards, and gold-exchange standards (a watered-down version), failed to survive the challenges of the first world war, interwar economic turbulence and US overspending in Vietnam. The most recent gold standard, established at the Bretton Woods conference in 1944, collapsed in 1971. Standards are hindered by problems such as hoarding, unilateral currency devaluations and countries going in at the wrong rate.

(2) James Titcomb, The Daily Telegraph (7th January, 2015)

The circumstances leading up to the Bank of England’s abandonment of the gold standard in 1931 have been detailed by letters between the Bank and the government from the period, which were released today.

Amid the Great Depression, during which many countries around the world sufferered economic turmoil, investors in Paris and New York lost confidence in the pound.

At the time, sterling was pegged to bullion. This meant that the pound was worth a fixed amount compared to other currencies and gold itself. In order to ensure that sterling retained its value, the Bank of England was obligated to exchange gold for pounds at the specified rate.

However, as political turmoil engulfed the UK, the country’s first national government – a coalition between Labour and the Conservatives – presided over a budget crisis that triggered a run on the pound.

Minutes from the Bank’s court in 1931, published on Wednesday, detailed how foreign exchange reserves were being drained to such an extent that the gold standard had to be abandoned.

References

(1) Mark Harrison, The Financial Times (16th June, 2013)

(2) Robert Skidelsky, The Financial Times (15th February, 1998)

(3) Richard G. Lipsey, An Introduction to Positive Economics (1975) pages 683-702

(4) Simon Taylor, Germany 1918-1933: Revolution, Counter-Revolution and the Rise of Hitler (1983) pages 55-59

(5) Clive Ponting, Winston Churchill (1994) page 293

(6) Winston Churchill, letter to Sir Richard Hopkins (28th November, 1924)

(7) Clive Ponting, Winston Churchill (1994) page 294

(8) Robert Skidelsky, The Financial Times (15th February, 1998)

(9) Percy J. Grigg, Prejudice and Judgment (1948) page 184

(10) Winston Churchill, memorandum to Otto Niemeyer (22nd February, 1925)

(11) Roy Jenkins, Churchill (2001) page 399

(12) Martin Gilbert, Churchill: A Life (1991) page 469

(13) Roy Jenkins, Churchill (2001) page 401

(14) Winston Churchill, speech in the House of Commons (28th April, 1925)

(15) Geoffrey Dawson, letter to John Maynard Keynes (July, 1925)

(16) Robert Skidelsky, John Maynard Keynes: Hopes Betrayed 1883-1920 (1983) page 202

(17) John Maynard Keynes, The Economic Consequences of Mr. Churchill (July, 1925)

(18) Selina Todd, The People: The Rise and Fall of the Working Class (2014) page 46

(19) Clive Ponting, Winston Churchill (1994) page 298

(20) Tom Johnson, speech in the House of Commons (8th September, 1931)

(21) John Maynard Keynes, speech made to a group of MPs in the House of Commons (16th September, 1931)

(22) John Maynard Keynes, Evening Standard (10th September, 1931)

(23) John Maynard Keynes, New Statesman (12th September, 1931)

(24) Robert Skidelsky, John Maynard Keynes: The Economist as Saviour 1920-1937 (1992) pages 396-397