Fordney-McCumber Act

During the 1896 Presidential Election the Republican Party candidate, William McKinley, promised to take action to protect the home market. The following year, the Dingley Act imposed duties on wool and hides which had been duty-free since 1872. Rates were increased on woolens, linens, silks, china, and sugar (the tax rates for which doubled). Over the next 12 years it imposed an average of 46.5 per cent. (1)

In 1909 President William Howard Taft called Congress into a special session to discuss the tariff issue. This resulted in the Payne-Aldrich Act. This reduced some tariffs and increased others. The issue was very controversial and led to a deep split in the Republican Party. Overall it reduced to tariffs to about 40.8 per cent. This was followed by the Underwood-Simmons Tariff in 1913 that lowered rates to 25 per cent. (2)

During the First World War the situation changed dramatically when President Woodrow Wilson decided to intervene in the market. On 10th August, 1917, Herbert Hoover was appointed as head of the United States Food Administration, an agency responsible for the administration of the U.S. army overseas and allies' food reserves. The new law forbade hoarding, waste, and "unjust and unreasonable" prices and required businesses to be licensed. During this period "Hooverize" entered the dictionary as a synonym for economizing on food. (3)

One senator protested that Wilson had given Hoover "a power such as no Caesar ever employed over a conquered province in the bloodiest days of Rome's bloody despotism". Hoover replied that, "Winning a war requires a dictatorship of some kind or another. A democracy must submerge itself temporarily in the hands of an able man or an able group of men. No other way has ever been found." (4)

Hoover's main objectives was to persuade farmers to grow more and grocery shoppers to buy less so that surplus food should be sent to America's overseas allies. Hoover established set days for people to avoid eating specified foods and save them for soldiers' rations. For example, people were told not to eat meat on Mondays. In January, 1918, Hoover announced "the law of supply and demand... had been suspended." (5)

As head of the Food Administration's Grain Corporation, he informed millers that if they did not sell flour to the government at a price he determined, he would requisition it, and he told bakers they must make "victory bread or close." In another speech Hoover argued: "The law is not sacred... Its unchecked operation might even jeopardize our success in war... It is imperative... that economic thinkers denude themselves of their procrustean forumulas of supply and demand... for in a crisis... government must necessarily regulate the price, and all theories to the contrary go by the board." (6)

As a result of these measures farmers enjoyed rising prices and profits during the final states of the war. This led to increased output and farmers borrowed heavily to expand their acreage. For example, gross farm income in 1919 amounted to $17.7 billion. However, after the war prices began to fall and by 1921 total farm incomes amounted to only $10.5 billion.

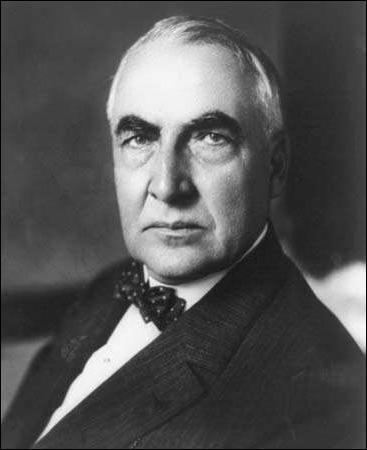

During the 1920 Presidential Campaign the Republican candidate, Warren Harding, promised to take measures to protect American farmers. It was thought that the rates under the Underwood-Simmons Act was too low. Joseph Fordney, the chair of the House Ways and Means Committee, and Porter McCumber, the chair of the Senate Finance Committee, introduced a bill which authorized the "Tariff Commission, working in an 'expert' and unpolitical way (and thus supposedly also independently of economic interests), to set rates so as to equalize the difference between American and foreign costs of production." (7)

In September 1922, the Fordney–McCumber Tariff Act was signed by President Harding. These raised tariffs to levels higher than any previously in American history in an attempt to bolster the post-war economy, protect new war industries, and aid farmers. "Duties on chinaware, pig iron, textiles, sugar, and rails were restored to the high levels of 1907 and increases ranging from 60 to 400 per cent were established on dyes, chemicals, silk and rayon textiles, and hardware." (8) Over the next eight years it raised the American ad valorem tariff rate to an average of about 38.5% for dutiable imports and an average of 14% overall. It has been claimed that the tariff was defensive, rather than offensive. (9)

In response to the Fordney-McCumber, most of American trading partners had raised their own tariffs to counter-act this measure. The Democratic Party that had opposed tariffs argued that it was to blame for the agricultural depression that took place during the 1920s. Senator David Walsh pointed out that farmers were net exporters and so did not need protection. He explained that American farmers depended on foreign markets to sell their surplus. The price of farming machinery also increased. For example, the average cost of a harness rose from $46 in 1918 to $75 in 1926, the 14-inch plow rose from $14 to $28, mowing machines rose from $45 to $95, and farm wagons rose from $85 to $150. Statistics of the Bureau of Research of the American Farm Bureau that showed farmers had lost more than $300 million annually as a result of the tariff. (10)

Although agriculture sector had problems during the 1920s, American industry prospered. The real wages of industrial workers increased by about 10 per cent during this period. However, productivity rose by more than 40%. Semi-skilled and unskilled workers in mass production, who were not unionized, lagged far behind skilled craftsmen and therefore was a growth in inequality: "The average industrial wage rose from 1919's $1,158 to $1,304 in 1927, a solid if unspectacular gain, during a period of mainly stable prices... The twenties brought an average increase in income of about 35%. But the biggest gain went to the people earning more than $3,000 a year.... The number of millionaires had risen from 7,000 in 1914 to about 35,000 in 1928." (11)

The farming community had not enjoyed the benefits of this growing economy. As Patrick Renshaw has pointed out: "The real problem was that in both agricultural and industrial sectors of the economy America's capacity to produce was tending to outstrip its capacity to consume. This gap had been partly bridged by private debt, easy credit, easy credit and hire purchase. But this would collapse if anything went wrong in another part of the system." (12)

Industrialists such as Henry Ford attacked the tariff and argued that the American automobile industry did not need protection since it dominated the domestic market and its main objective was to expand foreign sales. He pointed out that France raised its tariffs on automobiles from 45% to 100% in response to the measure. Ford and other industrialists tended to favour the idea of free trade. (13)

Primary Sources

(1) Harold James, The End of Globalization: Lessons from the Great Depression (2001)

The U.S. Fordney-McCumber Act of 1922 introduced a "flexible provision", which authorized the Tariff Commission, working in an "expert" and unpolitical way (and thus supposedly also independently of economic interests), to set rates so as to equalize the difference between American and foreign costs of production. This was to be the sole criterion for action by the commission.

(2) Alfred E. Eckes, Opening America's Market: U.S. Foreign Trade Policy Since 1776 (1995)

The Fordney-McCumber Act... represented a return to pre-World War I protection, for Congress feared European producers could undersell U. S. manufacturers. The Senate Finance Committee attributed foreign advantages to low wages, government subsidies, and lower taxation. Pursuant to the Underwood-Simmons Tariff, the U.S. ratio of duties collected to dutiable imports had averaged 27 per cent, down from 40.8 per cent under the Payne-Aldrich Tariff of 1909 and the 46.5 under the Dingley Tariff Act of 1897. Under Fordney-McCumber the average durable rate rose to 38.5 per cent. The average duty on all imports, which had fallen to 9.1 per cent, returned to 14 per cent.

(3) Neil Wynn, The A to Z from the Great War to the Great Depression (2009)

The Fordney-McCumber Act raised tariffs to levels higher than any previously in American history in an attempt to bolster the post-war economy, protect new war industries, and aid farmers. Duties on chinaware, pig iron, textiles, sugar, and rails were restored to the high levels of 1907 and increases ranging from 60 to 400 per cent were established on dyes, chemicals, silk and rayon textiles, and hardware. Tariffs on a variety of agricultural produce was raised. Although the tariffs encouraged the growth of monopoly in the United States, they also made it difficult for European powers to earn sufficient dollars to repay war debts. Other nations responded by increasing their tariffs thus limiting United States exports and constricting the market. These factors helped to create the weaknesses that produced the Depression.

Student Activities

Economic Prosperity in the United States: 1919-1929 (Answer Commentary)

Women in the United States in the 1920s (Answer Commentary)

Volstead Act and Prohibition (Answer Commentary)

The Ku Klux Klan (Answer Commentary)

Classroom Activities by Subject